The objective of financial inclusion is to extend the scope of activities of the organised financial system to include within its ambit people with low incomes. Through graduated credit, the attempt must be to lift the poor from one level to another so that they come out of poverty.

The Modi Government has laid the necessary infrastructure and made considerable progress to make this happen. It has achieved the objective of universal banking. DBT has been a great success. Over six crore PMJDY account holders have received DBT from various schemes. The beginning was made on 15th August 2014, when the Hon'ble Prime Minister announced PMJDY to fulfill the objective of universal financial inclusion taking banking to the last mile.

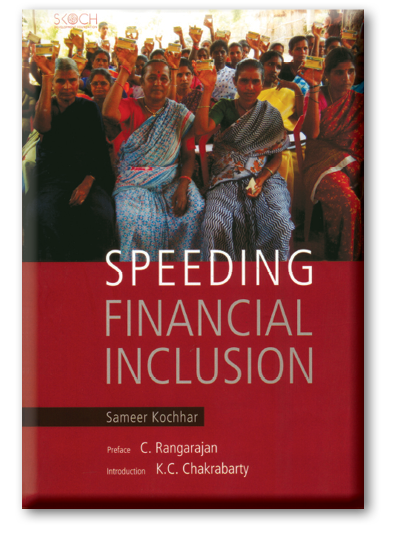

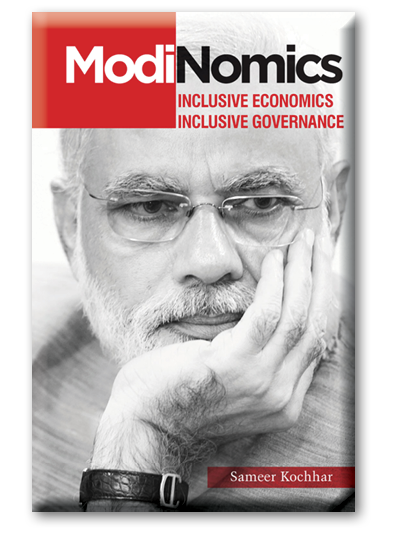

SKOCH Model of Inclusive Growth featured for the first time in the book, Financial Inclusion (2008) and shortly followed in the next book, Speeding Financial Inclusion (2009). These books had a pronounced policy impact. Most recommendations were accepted and implemented. ModiNomics (2014) again argued for inclusive economics and inclusive governance as per Modi Ji's Gujarat model.

The third book Defeating Poverty: Jan Dhan and Beyond (September 2014) contributed to the current spate of policy interventions like DBT, MUDRA, overdraft in Jan Dhan accounts and Payments. The roadmap for public digital infrastructure for financial inclusion was laid out in Modi's Odyssey: Digital India, Developed India (2016).

We have formed a Financial Inclusion Task Force (FITF) under the aegis of the SKOCH Development Foundation and the CEO's Association for Inclusive Growth (CAII) to return recommendations on digital lending and markets - bridging credit & literacy gaps.

Terms of Reference

Approach

Call for Submissions

Submissions are invited from stakeholders in Financial Inclusion journey of India:

• Met and Unmet Needs

• Opportunities and Challenges

• Solutions for enhancing credit penetration

• Solutions for enhancing Financial Literacy

• Innovative ways of raising finance, sureties and collateral

• Existing research, initiatives and inputs

• Selected submissions will be acknowledged and invited for presentation

and

and