SKOCH aims to steer FinTechs away from hype and help them see and address a real market through a fine balancing act between both supply side and demand side issues.

Register Now Read More Download BrochureSKOCH FinTech Awardees

The objective of financial inclusion is to extend the scope of activities of the organised financial system to include within its ambit people with low incomes. Through graduated credit, the attempt must be to lift the poor from one level to another so that they come out of poverty.

The Modi Government has laid the necessary infrastructure and made considerable progress to make this happen. It has achieved the objective of universal banking. DBT has been a great success. Over six crore PMJDY account holders have received DBT from various schemes. The beginning was made on 15th August 2014, when the Hon'ble Prime Minister announced PMJDY to fulfill the objective of universal financial inclusion taking banking to the last mile.

SKOCH Model of Inclusive Growth featured for the first time in the book, Financial Inclusion (2008) and shortly followed in the next book, Speeding Financial Inclusion (2009). These books had a pronounced policy impact. Most recommendations were accepted and implemented. ModiNomics (2014) again argued for inclusive economics and inclusive governance as per Modi Ji's Gujarat model.

The third book Defeating Poverty: Jan Dhan and Beyond (September 2014) contributed to the current spate of policy interventions like DBT, MUDRA, overdraft in Jan Dhan accounts and Payments. The roadmap for public digital infrastructure for financial inclusion was laid out in Modi's Odyssey: Digital India, Developed India (2016).

We have formed a Financial Inclusion Task Force (FITF) under the aegis of the SKOCH Development Foundation and the CEO's Association for Inclusive Growth (CAII) to return recommendations on digital lending and markets - bridging credit & literacy gaps.

SKOCH FITF Findings

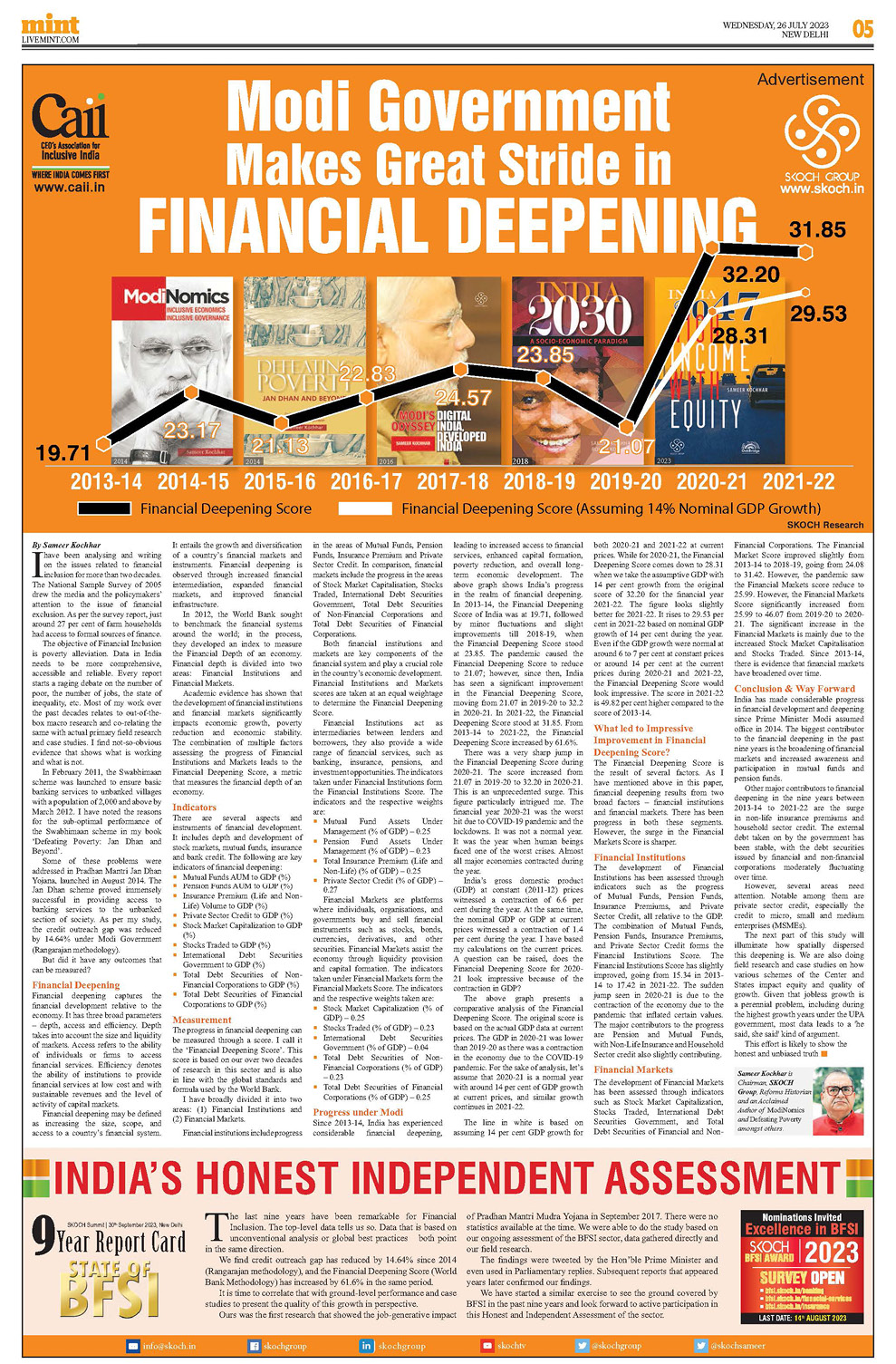

Modi Government Makes Great Stride in Financial Deepening by Sameer Kochhar

I have been analysing and writing on the issues related to financial inclusion for more than two decades. The National Sample Survey of 2005 drew the media and the policymakers’ attention to the issue of financial exclusion. As per the survey report, just around 27 per cent of farm households had access to formal sources of finance.

The objective of Financial Inclusion is poverty alleviation. Data in India needs to be more comprehensive, accessible and reliable. Every report starts a raging debate on the number of poor, the number of jobs, the state of inequality, etc. Most of my work over the past decades relates to out-of-thebox macro research and co-relating the same with actual primary field research and case studies. I find not-so-obvious evidence that shows what is working and what is not.

In February 2011, the Swabhimaan scheme was launched to ensure basic banking services to unbanked villages with a population of 2,000 and above by March 2012. I have noted the reasons for the sub-optimal performance of the Swabhimaan scheme in my book ‘Defeating Poverty: Jan Dhan and Beyond’.

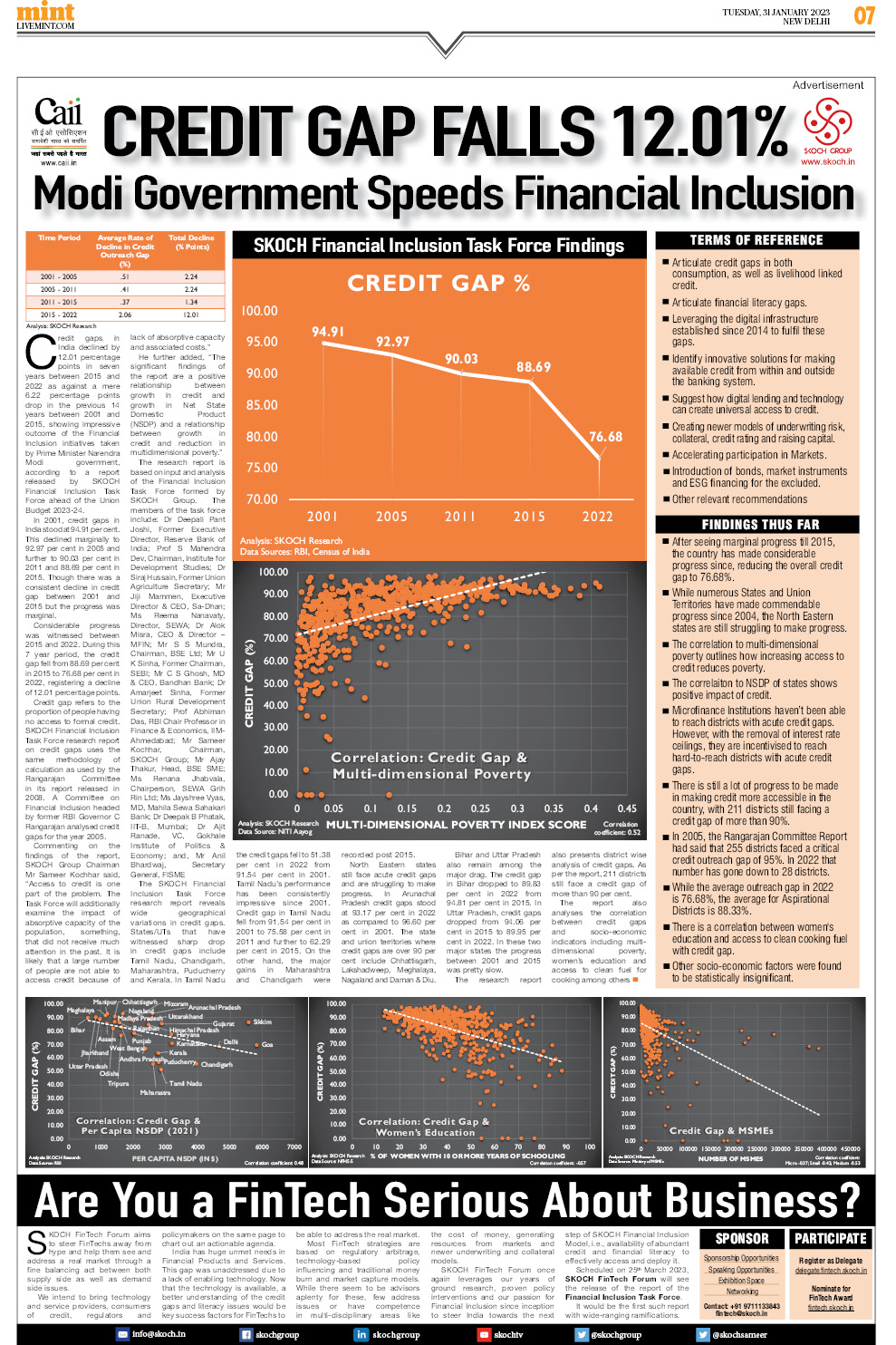

Credit Gap Falls 12.01% - Modi Government Speeds Financial Inclusion

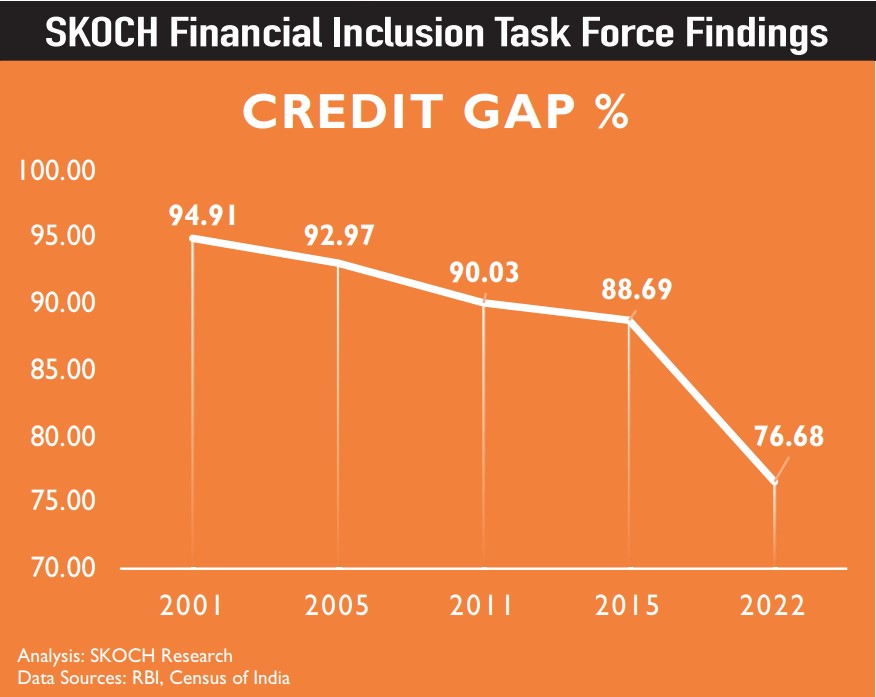

Credit gaps in India declined by 12.01 percentage points in seven years between 2015 and 2022 as against a mere 6.22 percentage points drop in the previous 14 years between 2001 and 2015, showing impressive outcome of the Financial Inclusion initiatives taken by Prime Minister Narendra Modi government, according to a report released by SKOCH Financial Inclusion Task Force ahead of the Union Budget 2023-24.

In 2001, credit gaps in India stood at 94.91 per cent. This declined marginally to 92.97 per cent in 2005 and further to 90.03 per cent in 2011 and 88.69 per cent in 2015. Though there was a consistent decline in credit gap between 2001 and 2015 but the progress was marginal.

Considerable progress was witnessed between 2015 and 2022. During this 7 year period, the credit gap fell from 88.69 per cent in 2015 to 76.68 per cent in 2022, registering a decline of 12.01 percentage points.

Credit gap refers to the proportion of people having no access to formal credit. SKOCH Financial Inclusion Task Force research report on credit gaps uses the same methodology of calculation as used by the Rangarajan Committee in its report released in 2008. A Committee on Financial Inclusion headed by former RBI Governor C Rangarajan analysed credit gaps for the year 2005.

Terms of Reference

Approach

Call for Submissions

Submissions are invited from stakeholders in Financial Inclusion journey of India:

• Met and Unmet Needs

• Opportunities and Challenges

• Solutions for enhancing credit penetration

• Solutions for enhancing Financial Literacy

• Innovative ways of raising finance, sureties and collateral

• Existing research, initiatives and inputs

• Selected submissions will be acknowledged and invited for presentation

Last Date: 15th May 2025

SKOCH FinTech Forum 2023

and

and

SKOCH FinTech Forum aims to steer FinTechs away from hype and help them see and address a real market through a fine balancing act between both supply side as well as demand side issues.

We intend to bring technology and service providers, consumers of credit, regulators, and policymakers on the same page to chart out an actionable agenda.

India has huge unmet needs in Financial Products and Services. This gap was unaddressed due to a lack of enabling technology. Now that the technology is available, a better understanding of the credit gaps and literacy issues would be key success factors for FinTechs to be able to address the real market.

Most FinTech strategies are based on regulatory arbitrage, technology-based policy influencing, and traditional money burn and market capture models. While there seem to be advisors aplenty for these, few address issues or have competence in multi-disciplinary areas like the cost of money, generating resources from markets, and newer underwriting and collateral models.

SKOCH FinTech Forum once again leverages our years of ground research, our proven policy interventions, and our passion for Financial Inclusion since inception to steer India towards the next step of SKOCH Financial Inclusion Model, ie availability of abundant credit and financial literacy to effectively access and deploy it. SKOCH FinTech Forum will see the release of the report of the Financial Inclusion Task Force.

It would be the first such report with wide-ranging ramifications.

Download BrochureSKOCH FinTech Award

Receiving a SKOCH Award is the best way to garner the attention of all relevant stakeholders.

It brings instant visibility and fame for the product amongst its customers, regulators, policymakers and other important stakeholders.

Given the rigour of the process, it is considered India's highest independent honour and is received and celebrated by ministers, Chief Ministers, Bureaucrats and Industry leaders alike.

Nominations are invited for SKOCH FinTech Award for exceptional / innovative products, achievements and corporate contributions to Digital Financial Inclusion. Evaluations would be by a Jury to identify products, services and organisations to take note of, learn from and replicate.

The nomination(s) can be submitted online on the apply page. For any assistance you may reach our award secretariat at fintech@skoch.in.

How to apply for|participate in|win SKOCH FinTech Award?

Early Bird: 15th May 2025 | Conference Delegate Fee (for 4 Individuals from one organisation): Rs 35,000 + GST@18%

Last Date: 30th May 2025 | Conference Delegate Fee (for 4 Individuals from one organisation): Rs 40,000 + GST@18%

Go to Apply PageStep 1

Submit NominationStep 2

Delegate RegistrationStep 3

Are you a FinTech serious about Business?

Participate

Register as a Delegate in SKOCH FinTech Forum:

delegate.fintech.skoch.in

SKOCH Awardees*

* All brand logos above are registered trademarks or trademarks of their respective companies/organisations.

* These are some of the past awardees. Full list can be viewed at Past SKOCH Awards page.

Forum Calendar

Upcoming Conferences

About SKOCH Group

SKOCH Group is India’s leading think tank dealing with socio-economic issues with a focus on inclusive growth since 1997. SKOCH Group is able to bring an Indian felt-needs context to strategies and engages with fortune-500 companies, state owned enterprises, government to SMEs and community-based organisations with equal ease.

Phone: 0124-4777444Email: info@skoch.in

Our Mission

The repertoire of services include field interventions, consultancy, research reports, impact assesments, policy briefs, books, journals, workshops and conferences. SKOCH Group has instituted India's highest independent civilian honours in the field of governance, finance, technology, economics and social sector. The group companies include a consulting wing, SKOCH Consultancy Services Private Limited; a media wing, SKOCH Media; and a charitable foundation, SKOCH Development Foundation.

and

and